In today’s fast-paced world, the Return on Investment (ROI) concept is essential—not just for businesses, but for individuals making financial decisions. Whether you’re investing in a business, buying a home, or considering learning a new skill, understanding ROI helps you evaluate the value of your investment compared to its cost.

So, what exactly is ROI, and why is it important for everyone to grasp? In this article, we’ll break down the ROI formula, explain its importance, and show how it leads to smarter financial choices in both personal and professional contexts.

What is the ROI Formula?

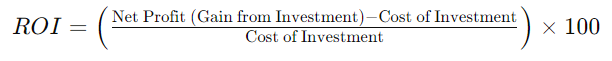

The Return on Investment (ROI) formula is a simple way to measure how profitable an investment is. It shows how much gain (or loss) is generated compared to the cost of the investment, expressed as a percentage. The basic formula looks like this:

In this formula:

- Net Profit represents the total gain or return from the investment (like revenue).

- Cost of Investment includes all expenses or resources spent.

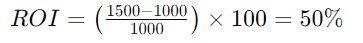

For example, if you invest $1,000 and get back $1,500, your net gain is $500. Using the ROI formula:

This means you earned a 50% return on your investment.

Why Understanding ROI is Important

1. It Helps You Make Smarter Financial Decisions

At its core, ROI is a tool for making informed decisions. Whether for personal or business use, knowing the ROI helps you figure out if an investment is worth the time, money, or effort. By comparing potential returns to costs, you can decide whether an investment is likely to be profitable or not.

For example:

- If you’re a business considering a marketing campaign, calculating the ROI helps determine if it will bring in enough revenue to justify the expense.

- As an individual, you might use ROI to decide whether the cost of a training course is worth the potential salary increase it could bring.

Without understanding ROI, people can easily make decisions based on gut feelings or incomplete information, leading to financial losses.

2. It Applies to Both Personal and Business Investments

One of the greatest strengths of ROI is that it can be applied to virtually any decision where resources are being invested.

For personal decisions:

- Education: Calculate the cost of a degree or certification against the salary boost it may provide.

- Home Improvements: Use ROI to decide if the increase in your home’s value is worth the renovation costs.

For business decisions:

- Product Launches: ROI helps determine if the revenue from a new product will cover the production and marketing costs.

- Tech Upgrades: Companies use ROI to see if new software or equipment will pay off in the long run through increased efficiency.

3. It Promotes Accountability and Efficiency

Using ROI encourages both individuals and businesses to be more efficient with their resources. It forces you to ask important questions:

- Are we getting enough value from this investment?

- Could we use our resources more wisely?

- What are the risks and rewards?

Businesses use these questions to stay financially healthy. On a personal level, ROI helps you track whether financial decisions, like savings or investments, are maximizing your hard-earned money.

4. It Helps You Compare Different Investment Options

When choosing between multiple investment options, ROI helps you compare them side by side. This makes it easier to prioritize the most profitable option.

For example:

- If you’re comparing two marketing campaigns, you can use ROI to project which one will bring the highest return.

- As an investor, ROI helps you decide whether to invest in stocks or bonds based on their expected returns.

5. It Encourages Long-Term Thinking

ROI helps measure not just short-term profits but also long-term gains. It forces you to consider the bigger picture, including risks and the sustainability of returns over time.

For example:

- A high-return stock may bring short-term profits, but if it’s risky, you could lose money in the long run.

- Long-term investments like education or property may show a low short-term ROI, but the value typically increases over time.

How to Use ROI in Everyday Life

You don’t have to be a finance professional to benefit from using ROI in your daily decisions. Here are some ways to apply ROI:

- Career Growth: Before enrolling in a course or certification, calculate the ROI by comparing the cost of tuition to potential salary increases.

- Real Estate: When buying or renovating property, calculate the ROI to see if the increase in value or rental income justifies the cost.

- Time Management: If you’re learning a new skill or working on a side project, estimate the potential returns in terms of skill improvement or income, and compare that to the time invested.

- Personal Finance: Use ROI to compare different savings or investment options based on their expected returns over time.

In Conclusion

The Return on Investment (ROI) formula is a simple but powerful tool that helps everyone—from business owners to individuals—make smarter financial decisions. Understanding ROI allows you to clearly see the relationship between the cost of an investment and its potential returns.

By applying ROI to your life, you’ll be better equipped to make decisions that maximize your financial success. Whether you’re investing money, time, or resources, understanding ROI will help you think strategically, compare options, and make choices that lead to long-term benefits. If you would like to learn about more formulas that can help you, please visit our shop.