Many investors are surprised to learn that when comparing debt instruments like commercial paper and bonds, they use different day counts to calculate yields. Commercial paper uses a 360-day year, while bonds typically use a 365-day year (or 366 in leap years). Though both represent debt securities, financial conventions that have evolved over time root these differences in yield calculation.

In this article, we’ll explain the key differences between commercial paper and bonds, why they use different day conventions, and the impact this has on both investors and issuers.

What is Commercial Paper?

Corporations issue commercial paper as a short-term, unsecured debt instrument to cover immediate funding needs.. These could include paying suppliers or managing inventory. Maturities typically range from a few days to 270 days. Since commercial paper has no collateral, companies with strong credit ratings mainly issue it.

For companies, commercial paper is a flexible, low-cost way to raise funds. For investors, it provides low-risk, short-term yields with minimal risk, especially because well-rated companies issue it.

What are Bonds?

Governments, corporations, and municipalities issue bonds as long-term debt securities to raise capital for projects or operations. Maturity periods for bonds can range from one year to 30 years. Bonds usually pay interest, known as coupons, on a regular basis—often semiannually. At maturity, bondholders receive their principal back along with these interest payments.

Bonds are appealing to investors seeking a steady stream of income. However, they come with higher risks than short-term instruments like commercial paper, especially when interest rates fluctuate over time.

Key Differences Between Commercial Paper and Bonds

1. Maturity Period

Commercial Paper: Short-term maturities, typically from a few days up to 270 days.

Bonds: Long-term maturities, ranging from 1 to 30 years depending on the issue

2. Risk Level

Commercial Paper: Considered low risk due to the high credit ratings of issuing companies, but it’s unsecured.

Bonds: May be secured or unsecured, with varying levels of risk based on the issuer.

3. Interest Payments

Commercial Paper: Typically sold at a discount and redeemed at face value, with no periodic interest payments.

Bonds: Pay interest regularly, usually semiannually, providing consistent income to investors.

4. Investor Type

Commercial Paper: Attracts institutional investors such as money market funds seeking short-term, low-risk investments.

Bonds: Appeal to a broad range of investors looking for long-term, fixed-income opportunities.

Yield Calculation: Why 360 Days vs. 365 Days?

One of the most noticeable differences between commercial paper and bonds is the day count used for yield calculations. Commercial paper follows a 360-day year, while bonds use a 365-day year. But why does this discrepancy exist?

1. Commercial Paper: 360-Day Convention

Commercial paper adopts the 360-day convention, common in money markets. This simplifies interest calculations for short-term instruments by dividing the year evenly into 12 months of 30 days. Historically, this was helpful for manual calculations. Today, this convention still applies to many short-term instruments like certificates of deposit (CDs) and Treasury bills.

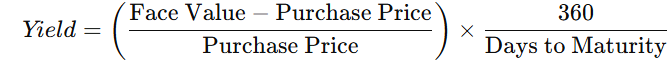

Here’s the formula for calculating the yield on commercial paper:

This formula calculates the discount yield, which is standard in money markets where interest is earned at the end of the investment period.

2. Bonds: 365-Day Convention

Bonds use the 365-day convention because they are long-term instruments with periodic interest payments. The actual/actual method is most common, meaning interest is based on the actual number of days between coupon payments and the number of days in the year. This makes the calculation more precise for longer-term investments.

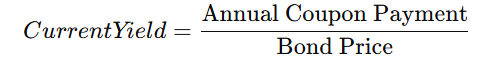

The current yield formula for bonds is:

When calculating bond prices or yields to maturity (YTM), the actual number of days is used, making the 365-day year more accurate for these calculations.

Why the Different Day Counts?

1. Simplification for Short-Term Interest

In earlier financial markets, simple calculations were essential. The 360-day year divides evenly by 12 months of 30 days, making manual interest calculations faster. This became the standard for short-term instruments like commercial paper.

2. Accuracy for Long-Term Instruments

For bonds, using 365 days ensures greater accuracy since interest is typically compounded and paid over the long term. The actual/actual convention reflects the true time value of money, accounting for leap years and the actual number of days between payments.

3. Market Segmentation

The difference in conventions also reflects the segmentation of financial markets. Money markets, where commercial paper operates, prioritize simplicity and quick calculations. Capital markets focus on accuracy and long-term yield calculations for trading bonds..

Impact on Investors and Issuers

Though it may seem minor, the difference between 360 and 365 days can have a noticeable effect on yields.

Commercial Paper Investors: The 360-day year slightly inflates annualized yields, making them appear higher than bond yields for similar periods.

Bond Investors: The 365-day convention gives a more precise calculation of long-term returns, especially over multiple years.

Issuers active in both short- and long-term markets must understand these differences to effectively manage their debt and structure their financing.

In Conclusion…

While commercial paper and bonds both represent forms of debt, their yield calculations highlight key differences between short- and long-term financial instruments. The 360-day year simplifies yield calculations for commercial paper, while the 365-day year provides more precision for bonds.

Understanding these conventions is crucial for both investors and issuers. It impacts how yields are compared, financial decisions are made, and ultimately, how funds are managed. Whether you’re considering short-term liquidity or long-term income, knowing the differences in yield calculation will help you make better investment choices.

If you would like to learn more about yields and financial formulas to advance your treasury career, please visit our shop.