In the world of corporate finance, treasury professionals play a critical role in ensuring that a company’s financial health is stable and its strategic goals are met. While the treasury department is often associated with tasks like cash management, liquidity planning, and risk mitigation, it’s essential that treasury professionals also have a firm grasp of key financial metrics that drive profitability. One such metric is the gross profit margin, a vital indicator of a company’s ability to generate profit from its core operations.

Understanding the gross profit margin formula is critical for treasury professionals because it provides insight into a company’s operational efficiency, cost management, and overall financial performance. In this article, we’ll explore why the gross profit margin is important, how it’s calculated, and why it matters for effective treasury management.

What is Gross Profit Margin?

Gross profit margin is a financial ratio that measures the percentage of revenue that exceeds the cost of goods sold (COGS). In other words, it represents the portion of sales revenue that the company retains after accounting for the direct costs involved in producing its goods or services.

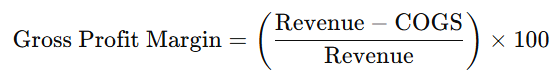

The formula for gross profit margin is:

Where:

- Revenue refers to the total sales or income generated from the company’s products or services.

- Cost of Goods Sold (COGS) includes the direct costs of producing the goods or services, such as materials, labor, and manufacturing expenses.

Example:

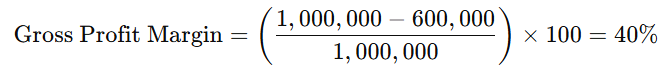

If a company generates $1,000,000 in revenue and its COGS is $600,000, the gross profit margin is calculated as follows:

This means the company retains 40% of its revenue as gross profit, with the remaining 60% going toward covering the direct costs of production.

Why is Gross Profit Margin Important for Treasury Professionals?

While the gross profit margin is traditionally associated with accounting and operational performance, it has significant implications for treasury professionals as well. Below are several reasons why understanding this metric is essential for treasury management:

Assessing Operational Efficiency

The gross profit margin provides a clear picture of how efficiently a company is managing its core operations. A higher gross profit margin indicates that the company is able to keep production costs low while generating strong revenue, which can positively impact the company’s overall profitability. Conversely, a low gross profit margin suggests inefficiencies in production or pricing strategies that may need to be addressed.

Why It Matters for Treasury Professionals: Treasury professionals are responsible for ensuring that the company has sufficient liquidity to meet its financial obligations. If a company has a consistently low gross profit margin, it may struggle to generate enough cash flow from operations to cover its short-term and long-term expenses. By understanding this metric, treasury professionals can help identify potential inefficiencies and work with other departments to improve cost management.

Evaluating Cash Flow and Liquidity Needs

The gross profit margin is directly linked to a company’s ability to generate cash flow from its core operations. A higher gross profit margin generally means that the company has more cash available to reinvest in the business, pay down debt, or distribute to shareholders. On the other hand, a low gross profit margin may indicate that the company is operating on thin margins, which can lead to cash flow constraints and liquidity challenges.

Why It Matters for Treasury Professionals: Cash flow management is one of the core responsibilities of the treasury function. By monitoring the gross profit margin, treasury professionals can gain insight into how much cash the company is generating from its day-to-day operations. This information is critical when making decisions about working capital management, debt repayment schedules, and capital investments.

Supporting Financial Planning and Forecasting

Treasury professionals are heavily involved in financial planning and forecasting, which requires an understanding of both historical and projected financial performance. The gross profit margin can serve as a key input in these forecasts, providing insight into how changes in pricing, production costs, or sales volumes might impact future profitability.

Why It Matters for Treasury Professionals: When preparing cash flow forecasts, treasury professionals need to estimate how much revenue the company will generate and how much of that revenue will be retained as gross profit. By understanding the gross profit margin, treasury professionals can create more accurate financial models and ensure that the company’s liquidity needs are met in both the short and long term.

Identifying Profitability Trends

Tracking the gross profit margin over time allows treasury professionals to identify trends in the company’s profitability. For example, a declining gross profit margin may indicate rising production costs, pricing pressure from competitors, or inefficiencies in the supply chain. On the other hand, an improving gross profit margin could signal better cost control or increased pricing power.

Why It Matters for Treasury Professionals: Identifying profitability trends is essential for managing financial risk. If the gross profit margin is declining, treasury professionals may need to adjust the company’s cash management strategy, such as by increasing liquidity reserves or renegotiating credit terms with suppliers. By staying on top of profitability trends, treasury professionals can proactively manage financial risks and ensure that the company remains on solid financial footing.

Supporting Debt Management and Financing Decisions

Gross profit margin also plays a role in determining the company’s ability to service debt and manage its capital structure. A company with a healthy gross profit margin is better positioned to generate enough operating profit to meet its debt obligations, which can result in more favorable terms when negotiating financing or refinancing agreements.

Why It Matters for Treasury Professionals: Treasury professionals are often responsible for managing the company’s debt and ensuring that it can meet its interest and principal payments. By understanding the gross profit margin, treasury professionals can assess whether the company’s operating profit is sufficient to support its debt load or whether additional measures are needed to improve cash flow and liquidity.

How Treasury Professionals Can Leverage the Gross Profit Margin

Understanding the gross profit margin is not just about tracking a single number—it’s about using that information to make informed decisions that impact the company’s financial health. Here are some ways treasury professionals can leverage the gross profit margin:

Set Financial Benchmarks: Use the gross profit margin to set benchmarks for profitability and operational efficiency. Treasury professionals can compare the company’s gross profit margin to industry averages to assess whether the company is performing above or below its peers.

Identify Cost-Cutting Opportunities: If the gross profit margin is declining, treasury professionals can work with other departments to identify areas where costs can be reduced without sacrificing product quality or sales volume.

Inform Capital Allocation Decisions: Treasury professionals can use the gross profit margin to determine how much cash is available for reinvestment in the business. For example, a company with a strong gross profit margin may have more flexibility to invest in growth initiatives, while a company with a lower margin may need to focus on improving operational efficiency.

Manage Supplier Relationships: A declining gross profit margin could be a sign that the company’s cost of goods sold is rising. Treasury professionals can use this information to renegotiate contracts with suppliers, explore alternative sourcing options, or implement cost-saving initiatives.

In Conclusion. . .

The gross profit margin is a fundamental financial metric that provides valuable insight into a company’s operational efficiency and profitability. For treasury professionals, understanding this formula is essential for managing liquidity, cash flow, and financial risk. By keeping a close eye on the gross profit margin, treasury professionals can help their organizations make more informed financial decisions, improve cost management, and ensure long-term financial sustainability.

Ultimately, the gross profit margin is more than just a measure of profitability—it’s a tool that treasury professionals can use to support strategic planning, optimize financial performance, and safeguard the company’s financial future.