Your cart is currently empty!

Why Future CTPs Must Know PV, FV, and NPV Differences

For aspiring Certified Treasury Professionals (CTPs), a deep understanding of financial concepts is essential to make informed decisions that drive corporate value. Among these concepts, three stand out as foundational to treasury management: Present Value (PV), Future Value (FV), and Net Present Value (NPV). These concepts are crucial in evaluating investments, understanding cash flows, and making long-term financial decisions.

This blog explores why it’s vital for treasury professionals to understand the differences between these three concepts and how they influence key financial decisions in corporate environments.

The Basics: Present Value (PV) and Future Value (FV)

Before diving into Net Present Value (NPV), it’s essential to first understand the fundamental concepts of Present Value (PV) and Future Value (FV). These two concepts represent different ways of valuing money at different points in time, and they are critical building blocks for treasury management.

Present Value (PV)

The Present Value (PV) is the current value of a future sum of money or stream of cash flows, discounted back to the present using a specific rate of return (often referred to as the discount rate). PV reflects the time value of money—the principle that a dollar today is worth more than a dollar in the future because of its potential to earn returns.

Example: Suppose you’re promised $1,000 a year from now, and the discount rate is 5%. The present value of that $1,000 is roughly $952.38 today. That means receiving $952.38 now is financially equivalent to receiving $1,000 a year from now at a 5% interest rate.

Why It Matters: Aspiring treasury professionals need to know how to calculate PV to assess the value of future cash flows and investments. This skill is essential when evaluating whether a future payout is worth the wait or if funds should be allocated elsewhere for immediate returns.

Future Value (FV)

The Future Value (FV) represents the value of a sum of money at a specified time in the future, based on an assumed rate of growth or interest. FV is essentially the reverse of PV—it shows what a current sum of money will grow to over time if invested at a certain rate of return.

Example: If you invest $1,000 today in an account that pays 5% annual interest, the future value of your investment after one year will be $1,050.

Why It Matters: Treasury professionals must understand FV to forecast the potential growth of investments, plan for future financial obligations, and evaluate the impact of different rates of return on cash flow projections. FV is critical when determining how much the company’s investments today will be worth in the future.

The Critical Concept: Net Present Value (NPV)

While PV and FV focus on the value of money at different points in time, Net Present Value (NPV) is a more advanced concept that helps treasury professionals evaluate investment opportunities and capital budgeting decisions.

Net Present Value (NPV)

Net Present Value (NPV) is a financial metric used to assess the profitability of an investment by comparing the present value of future cash inflows to the initial investment cost. NPV sums all the present values of the expected future cash flows and subtracts the initial investment, providing a clear measure of an investment’s potential to generate wealth.

Example: Suppose a company is considering a $10,000 investment in a project that will generate $3,000 per year for five years, and the discount rate is 6%. The NPV calculation will help the company determine if the total present value of those future cash flows exceeds the initial $10,000 investment.

Why It Matters: NPV is one of the most important tools for treasury professionals when making capital investment decisions. A positive NPV indicates that the project is expected to generate more value than it costs, while a negative NPV suggests the project will reduce the company’s value. Aspiring CTPs must be proficient in calculating and interpreting NPV to recommend investments that align with the company’s financial goals.

Why It Is Vital for Aspiring Certified Treasury Professionals to Understand the Difference Between Present Value, Future Value, and Net Present Value

For aspiring Certified Treasury Professionals (CTPs), a deep understanding of financial concepts is essential to make informed decisions that drive corporate value. Among these concepts, three stand out as foundational to treasury management: Present Value (PV), Future Value (FV), and Net Present Value (NPV). These concepts are crucial in evaluating investments, understanding cash flows, and making long-term financial decisions.

This blog explores why it’s vital for treasury professionals to understand the differences between these three concepts and how they influence key financial decisions in corporate environments.

The Basics: Present Value (PV) and Future Value (FV)

Before diving into Net Present Value (NPV), it’s essential to first understand the fundamental concepts of Present Value (PV) and Future Value (FV). These two concepts represent different ways of valuing money at different points in time, and they are critical building blocks for treasury management.

1. Present Value (PV)

The Present Value (PV) is the current value of a future sum of money or stream of cash flows, discounted back to the present using a specific rate of return (often referred to as the discount rate). PV reflects the time value of money—the principle that a dollar today is worth more than a dollar in the future because of its potential to earn returns.

- Example: Suppose you’re promised $1,000 a year from now, and the discount rate is 5%. The present value of that $1,000 is roughly $952.38 today. That means receiving $952.38 now is financially equivalent to receiving $1,000 a year from now at a 5% interest rate.

Why It Matters: Aspiring treasury professionals need to know how to calculate PV to assess the value of future cash flows and investments. This skill is essential when evaluating whether a future payout is worth the wait or if funds should be allocated elsewhere for immediate returns.

2. Future Value (FV)

The Future Value (FV) represents the value of a sum of money at a specified time in the future, based on an assumed rate of growth or interest. FV is essentially the reverse of PV—it shows what a current sum of money will grow to over time if invested at a certain rate of return.

- Example: If you invest $1,000 today in an account that pays 5% annual interest, the future value of your investment after one year will be $1,050.

Why It Matters: Treasury professionals must understand FV to forecast the potential growth of investments, plan for future financial obligations, and evaluate the impact of different rates of return on cash flow projections. FV is critical when determining how much the company’s investments today will be worth in the future.

The Critical Concept: Net Present Value (NPV)

While PV and FV focus on the value of money at different points in time, Net Present Value (NPV) is a more advanced concept that helps treasury professionals evaluate investment opportunities and capital budgeting decisions.

3. Net Present Value (NPV)

Net Present Value (NPV) is a financial metric used to assess the profitability of an investment by comparing the present value of future cash inflows to the initial investment cost. NPV sums all the present values of the expected future cash flows and subtracts the initial investment, providing a clear measure of an investment’s potential to generate wealth.

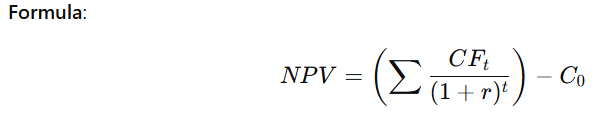

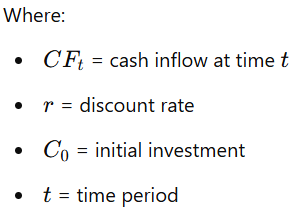

- Formula:NPV=(∑CFt(1+r)t)−C0NPV = \left(\sum \frac{CF_t}{(1 + r)^t}\right) – C_0NPV=(∑(1+r)tCFt)−C0Where:

- CFtCF_tCFt = cash inflow at time ttt

- rrr = discount rate

- C0C_0C0 = initial investment

- ttt = time period

- Example: Suppose a company is considering a $10,000 investment in a project that will generate $3,000 per year for five years, and the discount rate is 6%. The NPV calculation will help the company determine if the total present value of those future cash flows exceeds the initial $10,000 investment.

Why It Matters: NPV is one of the most important tools for treasury professionals when making capital investment decisions. A positive NPV indicates that the project is expected to generate more value than it costs, while a negative NPV suggests the project will reduce the company’s value. Aspiring CTPs must be proficient in calculating and interpreting NPV to recommend investments that align with the company’s financial goals.

Why Understanding the Differences Between PV, FV, and NPV Is Crucial for Aspiring CTPs

Informed Investment Decisions

In corporate treasury, every investment or capital allocation decision must consider both the present and future value of money. PV and FV help treasury professionals determine whether the returns from an investment are worth the cost and the time delay. NPV extends this understanding by incorporating both present and future values into a single calculation that directly impacts decision-making.

Example: A company may have $100,000 in excess cash and can choose between different investment opportunities. Understanding PV helps determine the value of the cash flows generated by those opportunities today, while FV shows the expected growth of the investment. NPV, however, allows the treasury professional to decide which option provides the best long-term value.

Effective Capital Budgeting

Capital budgeting involves evaluating potential projects and investments to ensure they meet the company’s required rate of return. PV, FV, and NPV are essential tools in this process, helping treasury professionals assess the viability of projects, prioritize investments, and ensure that resources are allocated efficiently.

Example: If a company is deciding between multiple projects, NPV provides a clear, quantifiable way to compare them. A project with a higher NPV is likely to generate more wealth for the company, making it the preferable option. Without understanding the underlying PV and FV calculations, aspiring CTPs would struggle to make accurate capital budgeting decisions.

Risk Management and Discount Rate Application

Treasury professionals must incorporate risk into their financial models, particularly when determining the discount rate used in PV and NPV calculations. The discount rate reflects the risk associated with future cash flows—higher risk typically demands a higher discount rate, reducing the present value of future returns.

Example: Suppose a company is considering an investment in a high-risk market. A higher discount rate would be applied in the PV and NPV calculations to account for the uncertainty of future cash flows. Aspiring CTPs need to understand how different discount rates affect both present value and net present value to make sound risk-adjusted decisions.

Maximizing Shareholder Value

The ultimate goal of corporate finance and treasury management is to maximize shareholder value. By mastering PV, FV, and NPV, aspiring treasury professionals can ensure that the company’s financial resources are used in a way that increases overall wealth. NPV, in particular, is a direct measure of how much value an investment will add to the company.

Example: If a company invests in a project with a positive NPV, it directly increases the firm’s value. However, if the NPV is negative, the company is effectively destroying value. Understanding how to calculate and interpret NPV enables treasury professionals to make decisions that align with the company’s financial goals and maximize returns for shareholders.

In Conclusion. . .

Understanding the differences between Present Value (PV), Future Value (FV), and Net Present Value (NPV) is vital for aspiring Certified Treasury Professionals. These concepts form the backbone of investment analysis, capital budgeting, and financial decision-making. Mastery of these financial tools enables treasury professionals to evaluate the value of money across time, assess the profitability of investments, and make strategic decisions that maximize shareholder value.

In summary, aspiring CTPs need to understand:

- Present Value (PV): To assess the current worth of future cash flows and make immediate decisions about investments and payments.

- Future Value (FV): To forecast the growth of investments and plan for future financial needs.

- Net Present Value (NPV): To compare investment opportunities, determine the profitability of projects, and guide capital allocation decisions that drive long-term value.

By understanding and applying these critical concepts, aspiring treasury professionals will be well-equipped to navigate the complexities of corporate finance and contribute meaningfully to their organization’s success.